new orleans sales tax 2021

Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018. Louisiana has state sales tax of 445 and allows local governments to collect a.

Sales Taxes In The United States Wikiwand

NEW ORLEANS WVUE - In order to fund the Blue Light Patrols in the Quarter the reinstatement of the quarter-cent sales tax is back on the.

. Groceries are exempt from the Orleans Parish and Louisiana state sales. The Orleans County sales tax rate is. New Rate Effective on all renewals on and after 1212019.

2022 List of Louisiana Local Sales Tax Rates. This is the total of state and county sales tax rates. Thursday August 19th the French Quarter Economic Development District Governing Authority the New Orleans City Council levied the new special sales tax voters approved in April.

The Louisiana state sales tax rate is currently. The Orleans Parish Louisiana sales tax is 1000 consisting of 500 Louisiana state sales tax and 500 Orleans Parish local sales taxesThe local sales tax consists of a 500 county sales tax. Revenue Information Bulletin 18-017.

Lowest sales tax 445 Highest sales tax 1145 Louisiana Sales Tax. The City of New Orleans today reminded residents the deadline for the 2022 property tax payments has been extended to March 15 2022. The local sales tax rate in new orleans louisiana is 945 as of november 2021.

The December 2020 total local sales tax rate was also 9450. 13 voters will get to choose Yes or No on proposed Constitutional Amendment No. Ad Get Louisiana Tax Rate By Zip.

Decrease in Overall State Sales Tax Rate to be Effective July 1 2018. By Wes Muller. These collections on sales began October 1 2021.

View sales history tax history. The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax and 5 Orleans Parish sales tax. The current total local sales tax rate in New Orleans LA is 9450.

2 lower than the maximum sales tax in LA. Did South Dakota v. New Orleans Mayor LaToya Cantrell on Friday voiced opposition to a proposed constitutional amendment on the upcoming November ballot that would create a single sales tax commission to replace Louisianas multiple tax collection authorities.

Sales Taxes Automobile Rental Excise Tax 9202021 Direct Marketer Sales Tax 9202021 Ernest N. In December voters rejected a ballot measure to renew the. This is the total of state parish and city sales tax rates.

1175 675 5 912020. Department of Finance Bureau of Revenue - Sales Tax 1300 Perdido St RM 1W15 New Orleans LA 70112. Required Filing Tax Form.

Revenue Information Bulletin 18-019. 1 which would create the. The ballot measure that passed on April 24 authorized a new 0245 Quarter for the Quarter sales tax within the French Quarter that was to go into effect July 1.

A similar tax was approved by voters in 2015 and expired at the end of 2020. The minimum combined 2022 sales tax rate for New Orleans Louisiana is. Revenue Information Bulletin 18-016.

French Quarter EDD Imposed A New SalesUse Tax Rate at 0245 effective Beginning October 1 2021 Ending June 30 2026 Form 8010 Effective Starting July 1 2019 Present. The Parish sales tax rate is. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in New Orleans LA at tax lien auctions or online distressed asset.

What is the sales tax rate in New Orleans Louisiana. The 2018 united states supreme court decision in south dakota v. NEW ORLEANS The City of New Orleans today issued the following statement on the Quarter for the Quarter sales tax collection that was originally set to go into effect July 1 2021.

13 voters will get to choose Yes or. Property located at 2021 Sixth St New Orleans LA 70115 sold for 25000 on May 29 1973. The 2018 United States Supreme Court decision in South Dakota v.

For tax rates in other cities see Louisiana sales taxes by city and county. The New York state sales tax rate is currently. Free Unlimited Searches Try Now.

Members of the New Orleans City Council voted Thursday to place a ballot initiative on the April 24 election ballot to reinstate a quarter cent sales tax to pay for supplemental police patrols in the French Quarter. The estimated 2021. Hotelmotel sales tax return and hotel occupancy privilege tax return for hotelmotelbed and breakfast establishments.

Occupancy and Sales Taxes. Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out Sales tax new orleans online e-sign them and quickly share them without jumping tabs. Morial Convention Center Service Contractor Tax and Tour Tax 9202021 Sales and Use Tax Monthly Return 9202021 HotelMotel Sales Tax 9202021 New Orleans Exhibition Hall Authority Additional Hotel Room Occupancy Tax and Food and.

All property tax bills for 2022 have been mailed and are also available online. Printing and scanning is no longer the best way to manage documents. The minimum combined 2022 sales tax rate for Orleans County New York is.

New orleans sales tax 2021. What is the sales tax rate in Orleans Parish. You can print a 945 sales tax table here.

On April 24th 72 of voters in the French Quarter Management District elected to bring back the quarter cent sales tax for. This is the total of state and parish sales tax rates. The 2018 United States Supreme Court decision in South Dakota v.

Sales Tax Rates - July 1 2018. The Louisiana sales tax rate is currently. Handy tips for filling out New orleans sales tax online.

Tax Liens List For Properties In And Near New Orleans LA How do I check for Tax Liens and how do I buy Tax Liens in New Orleans LA. New Orleans LA currently has 3812 tax liens available as of March 30. Tammany parish sales tax nov.

The Orleans Parish sales tax rate is. HotelMotel Sales Tax Return and Hotel Occupancy Privilege Tax return for HotelMotelBed and Breakfast establishments. There is no applicable city tax or special tax.

The Orleans Parish Sales Tax is collected by the merchant on all qualifying sales made within Orleans Parish. The New Orleans sales tax rate is. The minimum combined 2022 sales tax rate for Orleans Parish Louisiana is.

Average Sales Tax With Local. 2 beds 1 bath 465 sq.

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

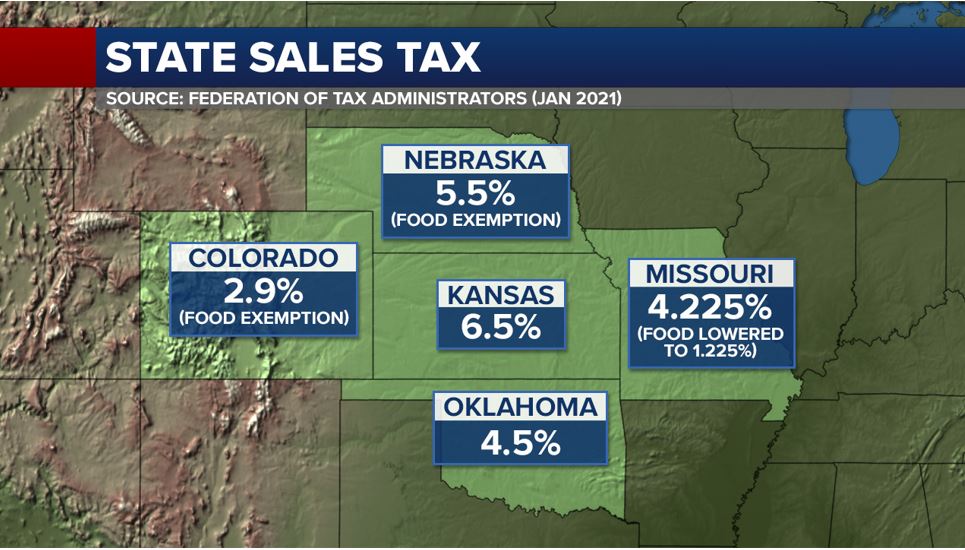

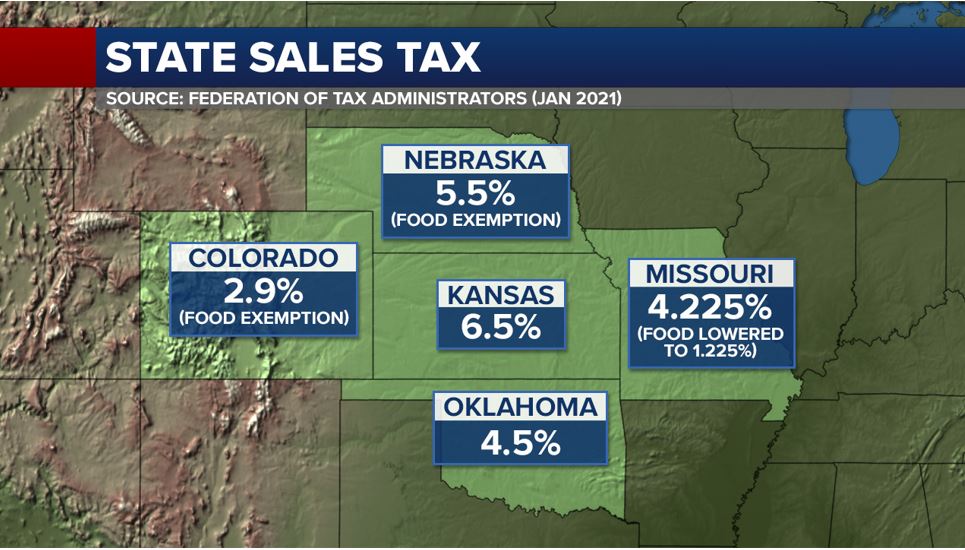

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

New Orleans Louisiana S Sales Tax Rate Is 9 45

Us Sales Tax Checklist For Non Resident Businesses

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Louisiana Lawmakers Approve Centralized Sales Tax Commission

City Comes Out Against Amendment 1 But Some Opsb Members Express Support The Lens

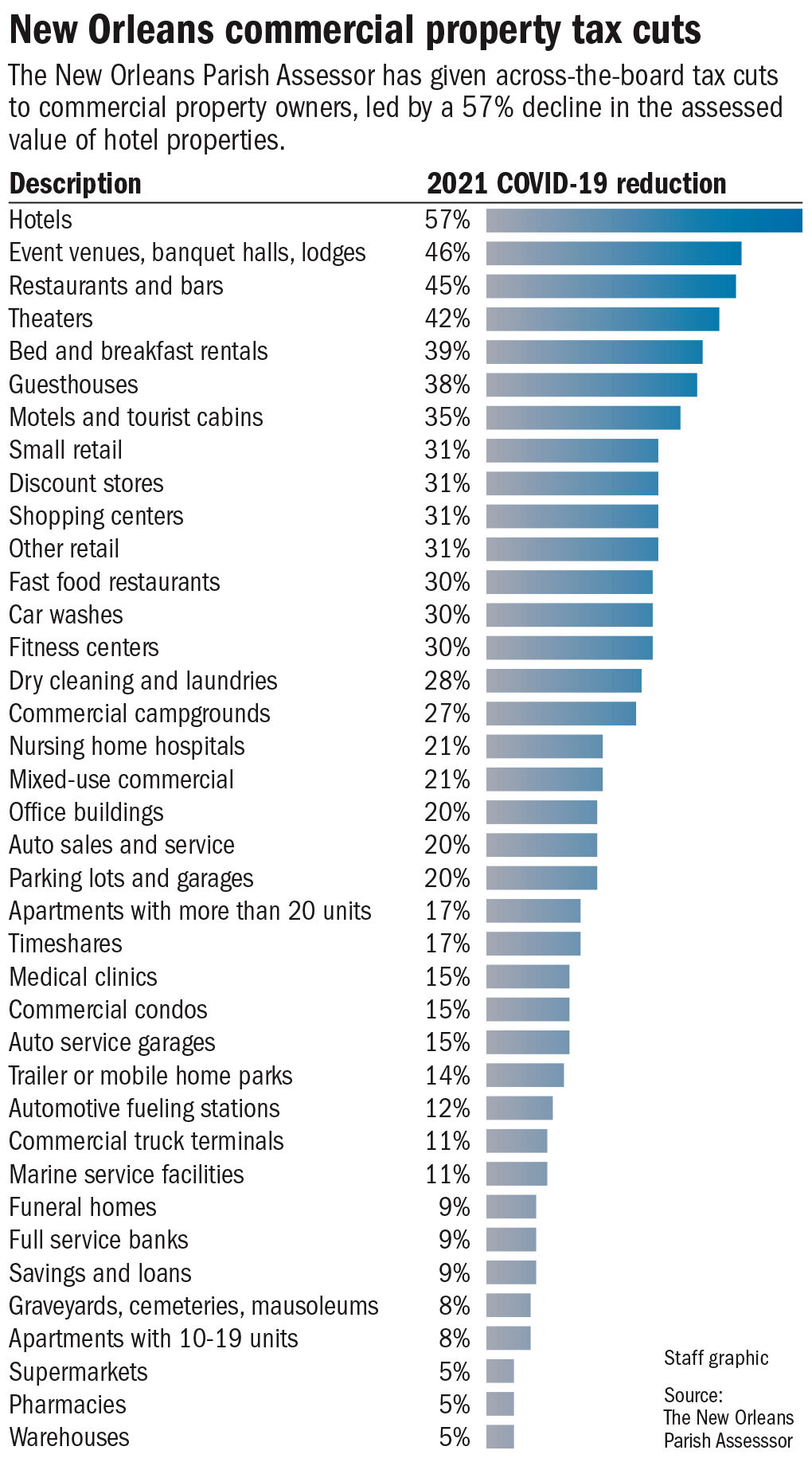

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nola Com

Sales Tax Updates Covid 19 Taxconnex

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

6 Differences Between Vat And Us Sales Tax

New Orleans City Council Approves Somber Budget For 2021 The Lens

Louisiana Sales Tax Small Business Guide Truic

Sales Tax Holidays Politically Expedient But Poor Tax Policy

Analysis Shows Louisiana Has Highest Combined Sales Tax In U S Biz New Orleans

Sales Tax On Grocery Items Taxjar

Bill To Streamline Sales Tax Collections In Louisiana Clears First Hurdle