how to put instacart on taxes

This includes self-employment taxes and income taxes. Get the scoop on everything you need to know to make tax.

How To Become An Instacart Shopper Pros Cons Pay Job Application

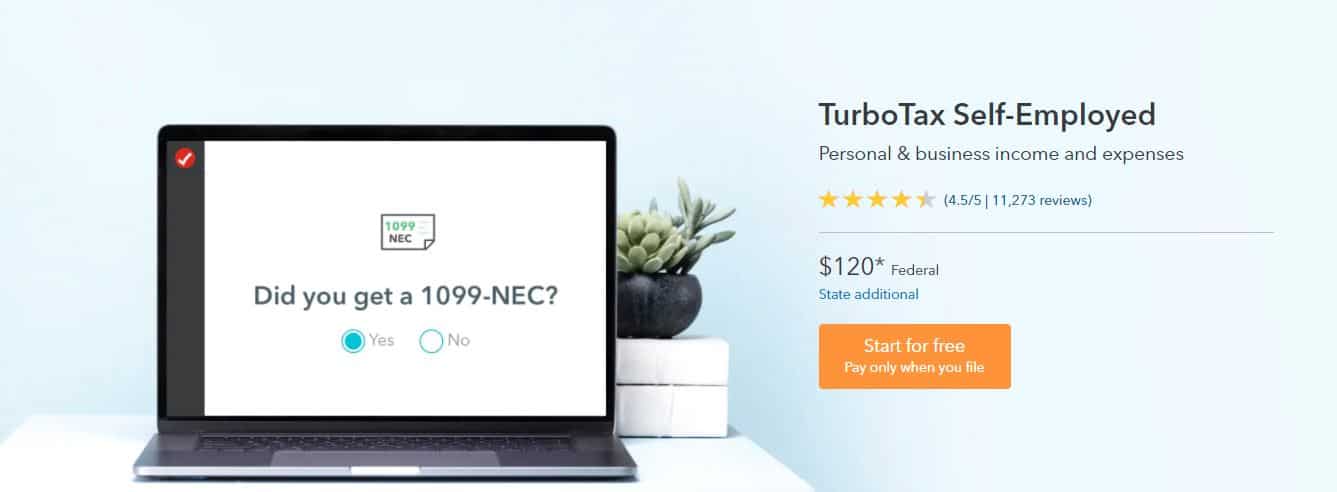

With TurboTax Live youll be able to get unlimited advice.

. You can find this in your shopper account or keep records in your own bookkeeping app. I just put in the 1099 form once a year but I literally write off all my miles insurance internet car bill etc. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Instacart Shoppers weve put together a custom tax guide for you complete with insider tips from our tax specialists. Depending on your state youll likely owe 20-25 on your earnings from instacart. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

By early January 2022. Instacart delivery starts at 399 for same-day orders over 35. Instacart partners with Stripe to file 1099 tax forms that summarize your earnings.

Irs free file site gives you access to. Tax tips for Instacart Shoppers. I end up getting a refund.

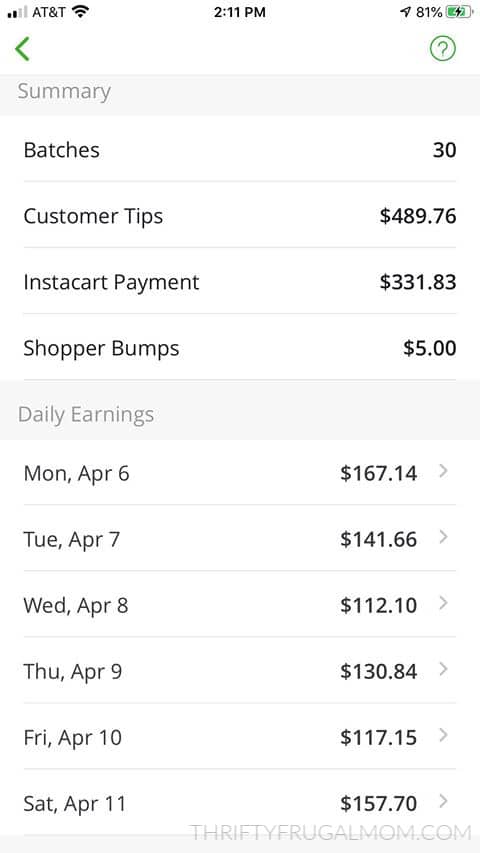

Youll be getting a 1099 from Instacart in early 2021 for the 2020 tax year. The organization distributes no official information on temporary worker pay however they do. As of December 2020 159 shoppers reported a range of earnings from 7 to 21 per.

Instacarts official name is Instacart other delivery companies use different legal names. So if you have other income like W2 income your extra business income might put you into a higher tax bracket. You must make quarterly estimated tax payments for the current.

According to Glassdoor in-store Instacart shoppers earn an average of 13 per hour. Learn how to file your 1040 and reduce taxes as an Instacart shopper in. Weve put together some FAQs to help you learn more about 1099s and.

Paper forms delivered via mail may take up to an additional 10 business days. Be sure to file separate Schedule C forms for each separate freelance work that you do ie. There will be a clear indication of the delivery.

First fill out Schedule C with the amount you made as indicated in Box 7 on your Instacart 1099. Pay Instacart Quarterly Taxes. Same-Day Delivery Powered by Instacart is available to members in most metropolitan areas.

Weve put together some FAQs to help you learn more about how to use Stripe Express to review your. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly. Accurate time-based compensation for Instacart drivers is difficult to anticipate.

You pay 153 SE tax on 9235 of your Net. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Learn the basic of filing your taxes as an independent contractor.

Top 10 Tax Deductions for Instacart Personal Shoppers 2022. Your 1099 tax form will be sent to you by January 31 2022 note. Up to 6 cash back Get unlimited year-round tax advice from real experts with TurboTax Live Self-Employed.

What You Need To Know About Instacart Taxes Net Pay Advance

Self Employment Tax Explained Gig Economy Taxes Uber Lyft Grubhub Instacart 1099 Taxes Youtube

Does Instacart Track Mileage The Ultimate Guide For Shoppers

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

What You Need To Know About Instacart 1099 Taxes

Instacart Shopper Injury Protection Instacart Lawsuit Can You Sue Instacart Console Associates Accident Injury Attorneys

Reporting 1099 Delivery Driver Income On Your Taxes In 2022

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom

How Much Do Instacart Shoppers Make 2022 Update

When Does Instacart Pay Me A Contracted Employee S Guide

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Expands Ebt Snap Payments Program And Celebrates One Year Of Increasing Access To Food

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Delivering Inequality What Instacart Really Pays And How The Company Shifts Costs To Workers Payup

Instacart Driver Review 10k As A Part Time Instacart Shopper